Payment methods with loyalty program application

Today’s text is devoted to comparing the functional aspects of how to make payments using loyalty program applications equipped with the Pay module. In addition to the applications of the programs listed above, the material also takes into account the experience of using Orlen Pay, Green Caffè Nero (de facto YOYO solution) and Starbucks Rewards (formerly My Starbucks Rewards) applications.

The following issues are discussed in the text below:

- Which loyalty program applications in Poland offer mobile payments;

- Comparison of payment methods using loyalty program applications;

- Case study of Orlen Pay, Green Caffè Nero and Starbucks mobile applications;

- Analysis of the benefits of mobile payments for participants.

Payment methods with loyalty program application

All of the Pay solutions enable the achievement of the same goal. This is the payment of the amount shown on the invoice or fiscal receipt using the loyalty program application and thus the combining of the loyalty program identification and payment process into one. The method of payment itself is different in each of the analysed cases. Comparing five apps with the mobile payment functionality – the analysis of which is the basis for this text – four payment methods can be distinguished. These are:

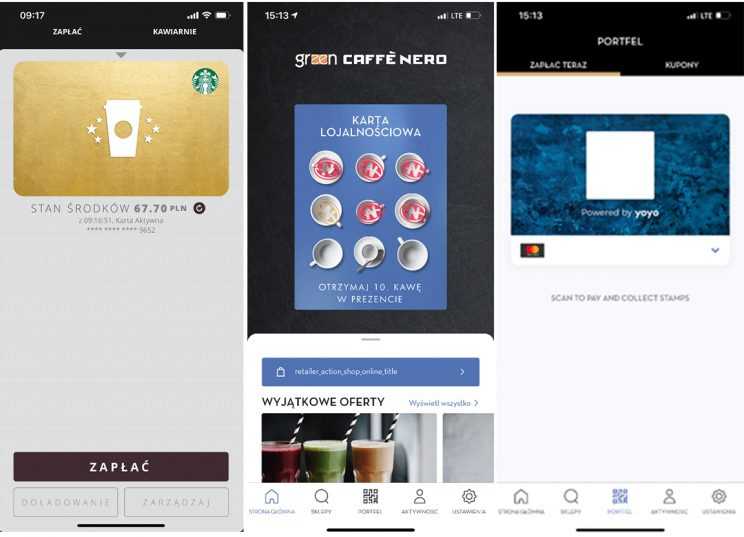

- displaying a virtual program card on the smartphone screen (in the form of a QR code) to be scanned by the cashier using a QR code reader at the cash register. No authorization for either of these two steps. This is how you pay with the Starbucks Rewards application;

- display on the smartphone screen of the virtual card of the program after prior authorization of access to the card (in the form of a QR code). The authorization is biometric or PIN-based (depending on the type of mobile device you have and its settings). The transaction itself is not additionally authorized. This is how you pay with Lidl Pay, Green Caffè Nero applications. The payment consists of reading the code with the reader at the cash desk. In both cases, the participant (buyer) may choose one of two options resulting from the card scan. It can only be points accrual, or points accrual and payment. In the Caffè Nero application we find the Wallet button. After pressing it, we can choose one of the two options “Collect Stamps Only” or indicate the payment card added. Interestingly, the application of the café chain communicates with the participant alternately in Polish and English. There is a simultaneous communication in two languages;

- authorization (biometric or PIN) of a specific transaction, the data of which is displayed on the smartphone screen after the cashier has scanned the loyalty card in the form of a barcode from the smartphone screen. Displaying the card itself is not subject to any authorisation. This is how you pay with the Żappka Pay application;

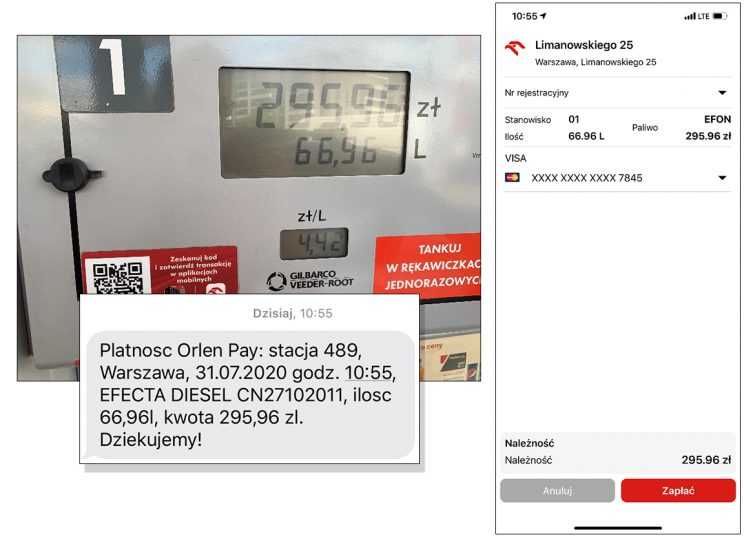

- authorisation (biometric or PIN based, additionally based on geolocation) of a specific transaction, the data of which is displayed on the smartphone screen after the buyer has scanned the QR code placed in the point of sale. The mere activation of the camera in the application is not subject to any authorization. This is how you pay with the Orlen Pay application;

In the first of the indicated payment methods, the payment is prepaid – it is actually the use of part or all of the value of the voucher. In the Starbucks Rewards program, the collection of points (stars) is conditional upon payment being made using a Starbucks Card (plastic or virtual in a mobile app). In the case of the other three methods, payment is made via the payment card connected to the application or (in the case of Orlen Pay) also via Apple Pay or Blik.

Only in case of Orlen Pay the whole procedure is independent of the role of the cashier and takes place at the distributor. The address of the station, station number, amount, number of litres or car wash programme is authorised on the smartphone screen. An invoice is also automatically generated, which is then available in the repository (similarly to e-paragons in Lidl Plus). In other cases, the cashier (in café chain programs – the barista) is an active participant in mobile payment transactions. Often this “human factor” is the cause of problems. Cashiers in Żabka must additionally enable the appropriate functionality on the cash register screen. Due to the fact that only a small percentage of payments are made using Żappka Pay, cashiers notoriously confuse the willingness to pay with Żappa Pay with the accrual of Żapps and the payment with Żapps for the purchased products.

As PKN Orlen’s solutions stand out from the organizers of other loyalty programs, it is worth taking a closer look at this offer.

Orlen Pay

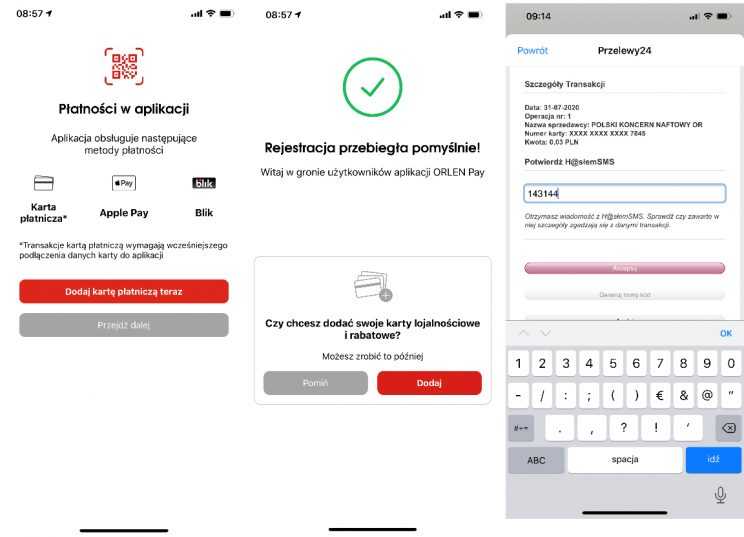

Orlen Pay, which initially seems to be a functionality of the VITAY application, is in fact a separate mobile application. In the VITAY application, there is the Pay with Orlen Pay button, but pressing it opens the Orlen Pay application. In order to use it, you must register “from scratch”. Being an active participant of the VITAY program for many years, I started my adventure with Orlen Pay by providing my first and last name. I didn’t find the “download data from the VITAY program” functionality. The registration process consists in providing personal data, the scope of which depends on whether we activate the “Company Account” button.

After making such a choice, the windows for entering the VAT number, company name and address, vehicle registration number and “invoice description” appear. The data is confirmed with a unique SMS code, which must be provided to the application. Orlen Pay supports payment cards (this requires that the card data be connected to the application), Apple Pay and Blik. Such a wide range of possibilities distinguishes this application from the available market offers. After adding a card, the system suggests the possibility of adding loyalty and discount cards, including VITAY, Biznes Tank and Big Family Cards. Adding a payment card is confirmed by a micropayment, which must be accepted by an SMS code.

It is a little awkward to ask for a number or to scan a VITAY card using your smartphone camera. Since PKN Orlen launched the VITAY mobile application, I have only been using its electronic form. It is surprising that the Pay application is not able to download the data from the database used by the VITAY application.

The payment process itself is very intuitive. We refuel, using the Orlen Pay application we scan the code from the sticker on the dispenser, then we approve the transaction in the application. Confirmation of payment by SMS and e-mail with an invoice are sent immediately after pressing “Pay”. You can drive away. I must admit that the first time I was looking in the mirror every now and then for a kilometer to check if nobody was chasing me…

Orlen Pay is the only application on the market that uses geolocation of a mobile device. The terms and conditions provide that the refusal to give consent to locate a mobile device may prevent the provision of services.

Mobile payments of café chains

The application containing the electronic form of the Starbucks Card is in practice an electronic purse. The account must be topped up first, which can be done with a payment card – the application is integrated with the PayU module or a bank transfer. The other loyalty program applications that offer the Pay module have their payment cards attached and they charge funds “on the go”.

It is interesting that in the terms and conditions of the Starbucks Rewards loyalty program, the organizer applied the concept, under which the Starbucks Card is issued as an “electronic form of a bearer voucher”, and the service provided by the issuer of the voucher, i.e. Amrest Coffee Sp. z o.o., consists in enabling transactions with the use of the card. The organizer reserves that it is not electronic money or a payment card. The card is valid (in fact the funds from the top-up are active) for 12 months after the last card transaction. The maximum balance is PLN 1000.

The Green Caffè Nero application is a solution offered by YOYO. Using it gives the impression as if it was still in a beta version – the application features hidden development texts, whereby communication is carried out alternately in Polish and English. From the point of view of functionality, the mobile payment module of this cafe chain belongs to the same category as the Lidl Pay solution.

Mobile payment benefits for the participant

Which solution is most consumer-friendly? In i360, we think it’s Lidl Pay and Green Caffè Nero. One authorization to display the card is enough. An even simpler solution is offered by Starbucks – no authorisation whatsoever – but its prepaid nature is a major barrier to functionality. Are these the safest solutions? Certainly not.

The highest level of security is presented by Żappka Pay and Orlen Pay, as they require the acceptance of a specific transaction displayed on the screen. In the case of Orlen Pay, it is additionally supported by geolocation control. The benefit for the participant is the simplification of the payment process by combining it with identification in the programme. Pay modules of mobile applications eliminate the need to take out a physical payment card from the wallet and authorize it during the payment process. The benefit is clear, it simplifies the transaction and saves time. However, it requires trust as the payment card is connected to an external application.

The trend of mobile payments is definitely in line with the trend of combining payments and identification in the loyalty program, which has been predicted for many years on the i360 blog, resulting in the accrual of points or other vouchers. The organizers of other loyalty programs will certainly follow this path, which we will closely monitor.

Contact us to learn more.

We know everything about loyalty programs.

![]() Tomasz.Makaruk@i360.com.pl

Tomasz.Makaruk@i360.com.pl

![]() 22 331.09.97

22 331.09.97